No products in the cart.

Fake Money

Passing counterfeit currency

what is passing counterfeit currency?

Passing counterfeit currency is a serious in Canada, governed by strict laws and regulations. As technology advances, the methods for detecting and producing counterfeit money have evolved. Despite these advancements, counterfeit currency remains a concern for law enforcement agencies, businesses, and citizens alike.

counterfeit currency report

This essay provides an in-depth exploration of the legal, social, and technological aspects surrounding counterfeit currency in Canada in 2024, focusing on the legal consequences, preventive measures, historical context, and the role of both individuals and institutions in combatting this issue.

Legal Framework Governing Counterfeit Currency in Canada

The production, distribution, and use of counterfeit currency is illegal under Canadian law. The Criminal Code of Canada outlines various offenses related to counterfeit money. Sections 449-462 deal with counterfeit currency crimes, and they describe the specific offenses and their corresponding penalties. These sections cover crimes such as making counterfeit money, passing counterfeit currency knowingly, and possessing equipment used to make counterfeit notes.

One of the most relevant sections is Section 450, which outlines the offense of “uttering” counterfeit money, defined as knowingly passing counterfeit currency as genuine. The penalties for such offenses can range from fines to imprisonment. For example, a person found guilty of uttering counterfeit currency can face up to 14 years in prison.

In addition to the Criminal Code, the Currency Act and regulations set by the Bank of Canada also play an important role in regulating currency and deterring counterfeit activity. The Bank of Canada is responsible for the design and issuance of Canadian banknotes and incorporates several advanced security features to make counterfeiting difficult.

Counterfeit Currency Trends in 2024

In 2024, the landscape of counterfeit currency in Canada has evolved with advancements in both counterfeiting techniques and anti-counterfeiting technologies. While the overall prevalence of counterfeit currency remains relatively low compared to other forms of financial crime, it is still a persistent issue, particularly in urban centers and in border regions.

Counterfeiters today often rely on sophisticated technologies, such as high-quality printers, 3D printing, and digital imaging software, to replicate the appearance of legitimate banknotes. However, advancements in forensic examination and currency design have also kept pace. Canadian banknotes, especially the polymer series introduced in 2011, have numerous security features, such as transparent windows, raised ink, holographic elements, and hidden text, which make them extremely difficult to replicate convincingly.

One notable trend in 2024 is the increasing use of counterfeit currency in online transactions and through informal peer-to-peer exchanges, particularly via online marketplaces and social media platforms. These platforms offer anonymity and facilitate smaller-scale exchanges, making it harder for law enforcement to track counterfeiters. Additionally, counterfeit bills are sometimes used in cash-heavy industries like hospitality, retail, and tourism, where quick transactions and busy environments may allow fake bills to circulate undetected for longer periods.

Technological Advancements in Counterfeiting Prevention

One of the most effective tools in the fight against counterfeit currency is technology. In 2024, Canada continues to implement new security features in its currency that are increasingly difficult to replicate. The polymer banknotes used in Canada are known for their durability and resistance to counterfeiting. They incorporate a range of sophisticated security features, including:

- Transparent Windows: Canadian banknotes have clear windows that are difficult to mimic using traditional counterfeit methods.

- Holographic Foil: Some denominations include holographic strips or patches that change appearance when tilted, providing a visual cue for authenticity.

- Microprinting and Fine Line Patterns: These intricate designs are challenging to replicate with standard commercial printing equipment.

- Raised Ink: On the front of Canadian banknotes, raised ink provides a tactile feature that is hard to reproduce.

- Ultraviolet Light Features: Many banknotes contain elements visible only under ultraviolet light, adding another layer of security for banks and businesses to detect counterfeit bills.

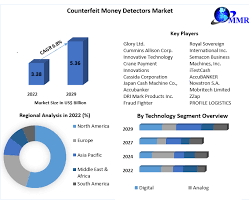

Moreover, in 2024, new digital detection tools are being used by businesses and financial institutions to quickly identify counterfeit bills. Portable counterfeit detection devices, which include ultraviolet scanners, magnetic ink detectors, and watermark readers, are becoming more affordable and accessible. These devices can instantly verify the authenticity of a banknote, making it harder for counterfeit bills to go undetected in retail settings.

Legal Consequences for Counterfeiting Offenses

The legal consequences of counterfeiting offenses in Canada are severe, reflecting the seriousness of this crime. Under the Criminal Code, several key offenses related to counterfeit currency carry heavy penalties.

- Making Counterfeit Money: A person who creates counterfeit currency is committing a serious indictable offense. This crime can lead to a maximum penalty of up to 14 years in prison. The creation of counterfeit currency requires intent, meaning the prosecutor must prove that the individual knowingly engaged in making false currency with the purpose of passing it off as real.

- Possessing Counterfeit Money: Under Section 450 of the Criminal Code, simply possessing counterfeit money, with the intent to use or distribute it, is also a criminal offense. Those found guilty of possessing counterfeit currency face similar penalties to those who produce it, with up to 14 years in prison.

- Passing Counterfeit Currency: Also known as “uttering” counterfeit money, this is the act of attempting to pass off a counterfeit bill as genuine currency. Even if an individual did not create the fake bill themselves, knowingly attempting to use it for financial gain is illegal and carries penalties of up to 14 years in prison.

- Possession of Counterfeiting Instruments: The law also criminalizes the possession of any tools or instruments that could be used to produce counterfeit currency. This includes printing devices, paper, or other specialized equipment that could aid in counterfeiting efforts.

In addition to criminal penalties, those caught dealing with counterfeit currency may face civil consequences, such as restitution to victims and damage to their personal and professional reputations. Counterfeiting is considered a “white-collar crime,” but its impact on victims, including businesses and individuals, can be far-reaching.

Social and Economic Impact of Counterfeit Currency

The social and economic impact of counterfeit currency in Canada is significant. Even though counterfeit money is a relatively rare problem compared to other types of fraud, its presence can undermine public trust in the monetary system and lead to financial losses for businesses and individuals.

For businesses, especially small ones, accepting a counterfeit bill can mean absorbing a financial loss, as banks will not reimburse businesses for counterfeit currency. This loss can be particularly damaging for small and medium-sized enterprises (SMEs) that operate on thin profit margins. For individuals, unknowingly receiving a counterfeit bill and then attempting to use it can lead to legal trouble if they are accused of knowingly passing counterfeit currency.

passing counterfeit currency Minnesota

Moreover, widespread use of counterfeit currency can lead to inflationary pressures, though this is less of a concern in Canada due to the relatively low rate of counterfeiting. However, if the issue were to grow, it could erode the value of money by increasing the amount of “fake” currency in circulation.

Another social impact is the link between counterfeit currency and organized crime. Counterfeiting is often tied to larger criminal enterprises, including drug trafficking, money laundering, and even terrorism. By disrupting the financial system with counterfeit currency, these groups can fund other illegal activities, further complicating the issue for law enforcement.

Measures to Prevent and Detect Counterfeit Currency

Preventing and detecting counterfeit currency requires a coordinated effort between law enforcement, businesses, financial institutions, and the general public. In Canada, several measures are in place to combat counterfeiting.

- Public Awareness Campaigns: The Bank of Canada plays a key role in educating the public on how to detect counterfeit currency. Through its “Know Your Money” program, the Bank offers resources to help Canadians recognize the security features on banknotes, including posters, handouts, and online tutorials.

- Training for Businesses: Businesses are on the front lines of the fight against counterfeit currency. Many retailers and cash-handling businesses train their employees to recognize the security features of Canadian banknotes. Cashiers and other staff members are often trained to use counterfeit detection devices, which have become more sophisticated and affordable in recent years.

- Collaboration with Law Enforcement: Canadian law enforcement agencies, including the Royal Canadian Mounted Police (RCMP), actively investigate and dismantle counterfeit operations. The RCMP’s Integrated Counterfeit Enforcement Team (ICET) works closely with local police forces and the Bank of Canada to track and prosecute counterfeiters.

- Banknote Examination: Financial institutions such as banks and credit unions play a vital role in identifying counterfeit bills. When a suspicious banknote is found, it is sent to the Bank of Canada for examination. If the bill is determined to be counterfeit, it is removed from circulation and reported to the authorities.

- Technological Tools: Advances in technology continue to aid in counterfeit detection. Many businesses now use automated cash handling systems that are equipped with counterfeit detection software. These systems can quickly scan a banknote’s security features and flag any discrepancies.

The Role of Digital Currency in Reducing Counterfeiting

In the long term, the rise of digital currencies may help reduce the prevalence of counterfeit currency. As more transactions are conducted electronically, the reliance on physical cash decreases. The Bank of Canada has been exploring the potential for a central bank digital currency (CBDC), which could serve as a secure and counterfeit-proof alternative to physical money.

Digital currencies, especially those backed by a central authority like the Bank of Canada, could provide a secure and verifiable means of conducting transactions. Since digital currencies are based on cryptographic technology, they are inherently resistant to counterfeiting. However, the shift to digital currency also brings challenges, such as ensuring the security of digital wallets and preventing cybercrime.

Conclusion

Passing counterfeit currency is a serious